Escrow Management

Fast. Efficient. Secure.

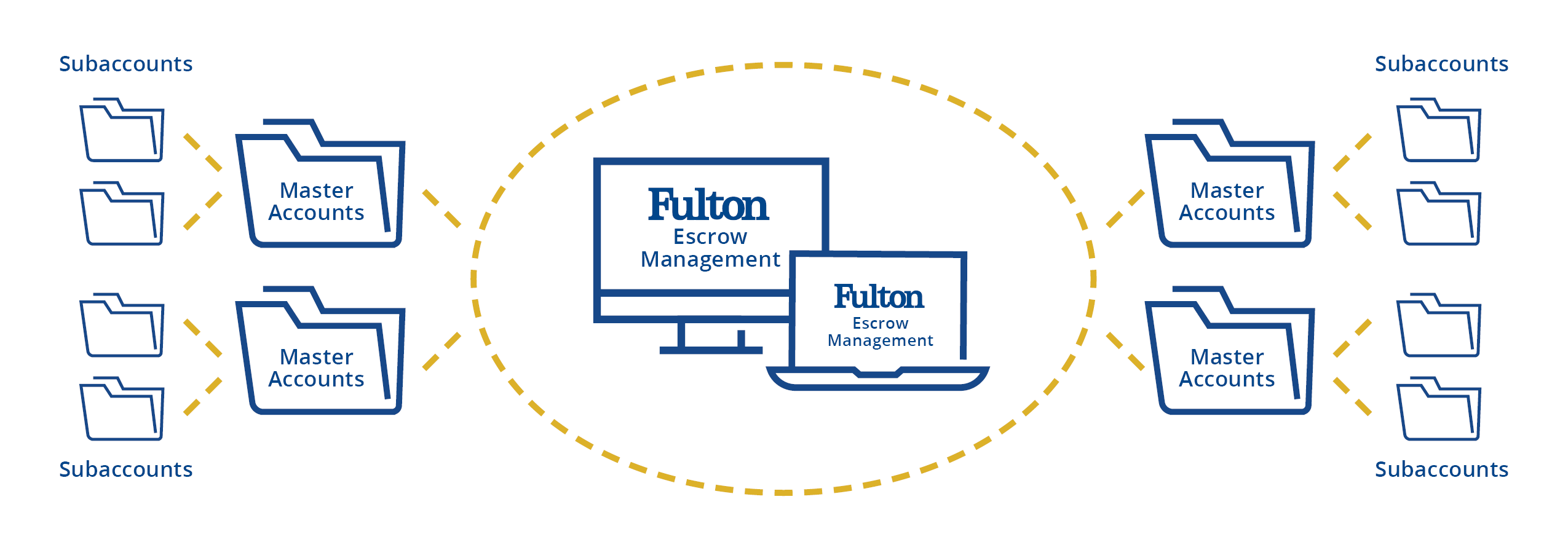

Cavity Escrow Management enables your business to efficiently manage all your escrow and subaccounting tasks in one simple but sophisticated platform. The Escrow Management platform works seamlessly with Cavity Bank’s online banking platform, allowing quick access to all the critical information you need from your business banking portal. You can open, close, fund, track, and organize subaccounts. It's an online platform like you've never used before.

Advantages of Cavity Escrow Management

- 24/7 online access for designated team members

- Quickly open, fund, manage or close escrow accounts

- Create as many digital folders as you need to match your internal filing system

- Access detailed reports and historical statements in just a few clicks

- Precise interest calculation and splitting

- API-first platform can connect to your in-house software

|

|

|

|

|

|

|

|

Cavity Escrow Management is ideal for:

- Government services: enabling secure management of community funds and surety bonds.

- Law firms: offering an efficient way to handle IOLTA/IOLA accounts for client funds.

- Property management firms: streamlining the process of managing tenant security deposits.

- Additional Industries: Title Companies, Real Estate, Retirement and Assisted Living, 1031’s, Funeral Homes, HOAs, and Non-Profits